MUDRA loan (Micro Units Development and Refinance Agency) Scheme under Pradhan Mantri MUDRA Yojana (PMMY) is an initiative to provide financial support to the Micro, Small or Medium-sized Enterprises (MSMEs). Sometime, MSMEs under proprietorship or partnership suffer from the lack of funding since the owners do not have collateral to secure a bank loan. Under PMMY scheme, policy guidelines were made for financing MSMEs, which in turn can grow faster by providing a boost to the rural economy, as well as improving the overall economy of India.

Contents

- 1 MUDRA loan – How to apply for MUDRA loan easiest Details Download at a financial institution?

- 1.1 Purpose of MUDRA Loan

- 1.2 How to apply for MUDRA loan?

- 1.3 Under the PMMY scheme, one can apply for 3 types of MUDRA loans:

- 1.4 Kinds of business entities that can avail the MUDRA loan:

- 1.4.1 MUDRA loan Business Information:

- 1.4.1.1 The Types of Facilities for savings bank account, current account or even cash credit account or term loan or even Letter of Credit or Bank Guarantee

- 1.4.1.2 The type of facilities in terms of cash or credit or term loan or even Letter of Credit or Bank Guarantee

- 1.4.1.3 In case of requirement for Term Loan, the detail of Machinery/ Equipment could be given as under:

- 1.4.1.4 The following figures are needed for the actual, estimated and proposed scenario.

- 1.4.1.5 Any other outstanding dues for Statutory requirement Declaration:

- 1.4.1 MUDRA loan Business Information:

- 1.5 MUDRA Yojana Important Links:

- 1.6 MUDRA Loan Application Form for ‘Shishu’ Loan

MUDRA loan – How to apply for MUDRA loan easiest Details Download at a financial institution?

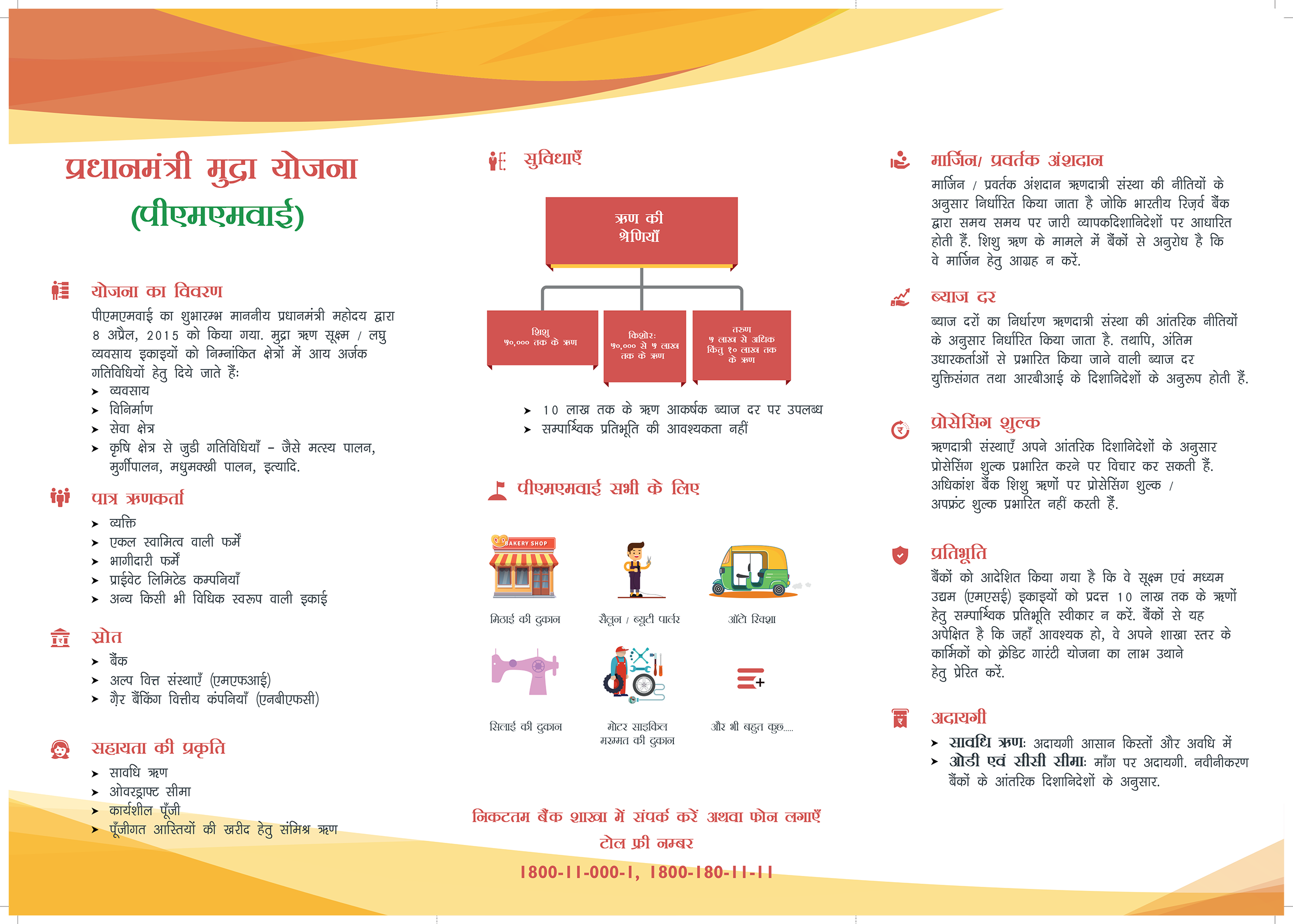

Pradhan Mantri MUDRA Yojana (PMMY) is a scheme launched by the Hon’ble Prime Minister on April 8, 2015 for providing loans up to 10 lakh to the non-corporate, non-farm small/micro enterprises. These loans are classified as MUDRA loans under PMMY. These loans are given by Commercial Banks, RRBs, Small Finance Banks, MFIs and NBFCs. The borrower can approach any of the lending institutions mentioned above or can apply online through this portal www.udyamimitra.in . Under the aegis of PMMY, MUDRA has created three products namely ‘Shishu’, ‘Kishore’ and ‘Tarun‘ to signify the stage of growth / development and funding needs of the beneficiary micro unit / entrepreneur and also provide a reference point for the next phase of graduation / growth.

Purpose of MUDRA Loan

MUDRA loan scheme was launched by the Government of India to help MSMEs with the following purposes:

- To start a new business

- For business expansion

- Buying plant & machinery

- To get working capital for business

- Hiring or training staff

- To buy equipment, commercial vehicles, etc.

How to apply for MUDRA loan?

The Pradhan Mantri MUDRA Yojana (PMMY) launched on 8th April 2015, provides loans to small business owners up to the amount of Rs.10 Lakh.

Following are the individuals who need to know how to apply for MUDRA loan under this scheme:

- Small manufacturing business owners

- Fruit and vegetable sellers

- Artisans

- Shopkeepers

- Those associated with various agriculture activities like livestock, dairy, pisciculture, poultry, fishery, etc.

How to apply for MUDRA loan at a financial institution?

Individuals have to follow the steps mentioned below to apply for MUDRA loan:

Step 1.Keep the necessary documents ready

Applicants need to have the necessary documents required to avail a MUDRA loan. These include identity proof (Aadhaar, Voter ID, PAN, Driving License, etc.), address proof (electricity bill, telephone bill, gas bill, water bill, etc.), proof of business (business registration certificate, etc.).

Step 2.Approach a financial institution

Individuals can apply for a MUDRA loan with almost all leading financial institutions in India.

Step 3.Fill in the loan application form

Applicants then have to fill the MUDRA loan application form and furnish their personal and business details. They also have to ascertain the amount they want to avail before knowing how to apply for MUDRA loan scheme.

Under the PMMY scheme, one can apply for 3 types of MUDRA loans:

Sishu – Covers loans up to Rs.50,000 for starting a business or for businesses in its early stages.

Kishor – Covers loans up to Rs.5 Lakh for already established businesses seeking additional funding.

Tarun – Covers loans up to Rs. 10 Lakh for well-established businesses meeting certain eligibility.

Once you’ve followed the above steps, the bank or financial institution will sanction the MUDRA loan into your account.

Some lending institutions also provide the option of Mudra Loan Online Apply

Leading NBFCs like Bajaj Finserv offer similar business loans for MSMEs up to Rs.30 lakh which can easily be applied for online. Such loans can be availed whenever there is a shortage of working capital, need to buy improved machinery & equipment, need for debt reconciliation, etc. These loans are quick to avail and can be used to address multiple financial requirements.

Preparation of standardized regulatory letters, which will prove to be a very important step for small businesses in the future.

- Future program

- Currency card

- Portfolio Credit Guarantee

- Credit enhancement

- Evaluation

At present, the scheme covers only areas like land, transport, community, social and personal services, food production, textiles, and many more new sectors will be added in the future, which gives a lot of opportunities to new industries. Small traders, businessmen will take advantage of this scheme and reach the pinnacle of success.

Applicant has to fill an application form, be it for the Shishu, Kishor or Tarun loan scheme. Download the application form from any given website of the list of banks institutions providing the loan. It is very convenient to apply for this loan application online, since this will avoid the hassle and commotion of going to the bank, waiting in line and then acquiring the loan application form. Below mentioned are simple steps to apply online:

Step 1: Download the loan application form

Step 2: Fill in the form details correctly

Step 3: Find the public or commercial sector bank

Step 4: Finish all the other formalities by the bank

Step 5: Once this process is done, the loan will be sanctioned

Kinds of business entities that can avail the MUDRA loan:

- Self-proprietors

- Partnerships

- Service sector firms

- Micro industries

- Repairing shops

- Owners of trucks

- Foodservice businesses

- Vendors (fruits and vegetables)

- Micro manufacturing firms

MUDRA loan Business Information:

- Complete name of the enterprise

- Constitution of the enterprise – Proprietary or Partnership or Private Limited or

- Limited Company or any other

- Current Business Address, including State and PIN Code

- Whether the Business Premises is self-owned or rented

- The contact details with the telephone and the mobile number

- An email ID for communication

- Existing and the proposed business activity

- An approximate date of commencement of business in DD/MM/YYYY format

- Registration details of the unit

- If it is registered, the following details are needed:

- The registration number and

- The act under which it is registered

- The registered address of the office

- The social category for application, whether Scheduled Caste or Tribe, Other

- backward Classes or any other Minority Community

- Complete Background Information of the Proprietor/ Partners/ Directors is needed

- Name, serial number, sex, date of birth and other personal details

- Contact details like email ID, phone number, registered residential address

- Highest academic qualification and professional degree

- Any valid proof of identity and address

- A copy of the PAN Card

- Director Identity Number or DIN for all the directors

- The total experience in the current line of business

- The relationship with the other officials/ directors, etc.

- Names of the Associate Concerns and the Nature of their Association

- The names of the Associate Concerns

- The addresses of Associate Concerns

- The current bank details

- The nature of the Association Concerns

- The extent of Interest as a Proprietor or a Partner or even a Director or maybe just as an Investor in Associate Concern

- Banking/Credit Facilities Existing (In Rs.)

The Types of Facilities for savings bank account, current account or even cash credit account or term loan or even Letter of Credit or Bank Guarantee

- The current bank details

- The total limit already availed

- The total outstanding as on date

- The security that has been lodged

- The asset classification status

- In case of currently banking with this bank, then Customer ID needs to be provided

- A certification statement from the borrowers that no loan was taken from any other bank or financial institution apart from the one mentioned in Section E

Total Credit Facilities Proposed: (In Rs.)

The type of facilities in terms of cash or credit or term loan or even Letter of Credit or Bank Guarantee

- The total amount

- The purpose for which it is required

- The details of the primary Security Offered (With an Approximate value to be mentioned)

- In Case of the Working Capital: On a Basis of Cash Credit Limit Applied: (In Rs.)The Actual Sales in the last two years

- The projected figures of the sales, revenue, inventory, working cycles, creditors and debtors, promoter’s contribution, total limits, etc.

In case of requirement for Term Loan, the detail of Machinery/ Equipment could be given as under:

- The type of the machine or the equipment

- The purpose for which it is required

- The name of the supplier

- The total cost of the machine

- The total contribution that is being made by the promoters in INR

- The total amount of loan that is required

- The period of repayment with moratorium period requested for

Past Performance/ Future Estimates: (In Rs.)

The following figures are needed for the actual, estimated and proposed scenario.

- Net Sales

- Net Profit

- Capital (Net Worth in case of Companies)

- Status Regarding Statutory Obligations:

For each Statutory Obligation, the borrower has to mention whether complied with by selecting ‘Yes’/ or ‘No’ as applicable. And if not applicable, mention ‘N.A.’ Also, in the ‘Remarks’ column in the form, any detail in connection with the relevant obligation to be given. Statutory Obligations are:

- Registration under the Shops and Establishment Act

- Registration under the MSME (Provisional/ Final)

- Drug License

- Latest Returns for Sales Tax Filed

- Latest Returns for Income Tax Filed

Any other outstanding dues for Statutory requirement Declaration:

- Declaration with photograph(s) and signature(s) of Proprietor/ Partners/ Director

Mention of Date and Place - Acknowledgement Slip for loan Application under Pradhan Mantri MUDRA Yojana

MUDRA Yojana Important Links:

Click to Official websites: click hare

Official Website: Link 1 , Link-2 , Link-3

Common Loan Application form for Kishor and Tarun: Form Gujarati

Application Form for Shishu: Link-1 , Link-2

Full Details Gujarati: Link-1, Link-2

MUDRA Loan Application Form for ‘Shishu’ Loan

There is one exclusive ‘MUDRA Loan Application Form’ for ‘Shishu’ category available on the same web site. This is much shorter than the general form since many sections do not apply at the inception of the business, a stage for which ‘Shishu’ loan is approved. ‘Shishu’ loan requires no processing fee and does not require any collateral. Repayment period could be extended up to 5 years.

Documentation Required

A list of the required documentation is mentioned towards the end of the form. Applicants have to furnish the pertinent documents based on the type of loan and the type of business they are applying for. These include:

- Identity Proof

- Residence Proof

- Proof of Minority and SC/ST

- Address and Identity Proof of Business Enterprise

- Bank Account Statement of past 6 months

- Balance sheet of the past 2 years along with Sale tax and/ or Income Tax return –

- This is applicable if the loan amount is over 2 lakh

- Projected balance sheet for 1 year for working capital limits. Projected balance

- sheets for the entire loan period in case of the term loan. – Both applicable for

- loans over 2 lakh

- Sales realized in the current financial year till the date of loan application submission

- For the proposed project, a report to be submitted that contains all the detail of technical and economic feasibility

- Partnership deed of partners for a partnership

- Memorandum and Articles of Association for a company

- In case a third party guarantee is not available, Asset and Liability statement might need to be furnished from the borrower(s), Directors and partners to find the net worth

- Two copies of the photo of the proprietor or each of the partners and directors

Under PMMY, MUDRA loans are offered through Commercial Banks, Rural - Regional Banks (RRBs), Small Financial Banks (SFBs), Cooperative Banks, Microfinance Institutions (MFIs) and so on. As on 31st March 2019, 59870318 counts of PMMY loans are sanctioned and the total loan amount sanctioned was Rs. 321722.79 crore.

MUDRA loan is meant for supporting the section of the population who are economically backward and who cannot secure a bank loan otherwise. It is mainly aimed for socio-economically backward people to improve their financial condition, to provide a livelihood for them and improve the rural economy overall. The loan is not meant for personal use.